HashKey Group expects more than 50% of institutional and professional investors to have exposure to this growing asset class by year end

HONG KONG, Jan. 20, 2021 /PRNewswire/ — HashKey Group, a leader in digital asset management and blockchain solutions, predicts that more than 50% of institutional and professional investors will have exposure to digital assets in their portfolios by year end.

This would mark 2021 as a tipping point where investors go from evaluating the opportunity to acting.

Large-scale government spending worldwide in the pandemic to support economic recovery and the evolving global regulatory framework are the primary reasons cited by investors diversifying into this growing asset class.

HashKey Group recently published its report entitled “Institutional Investor and Digital Assets. First Mover Advantage: What Early Adopters Have Learned” which shares insights from in-depth interviews conducted with institutional investment leaders from around the world.

According to the report, institutional investors expressed fear that they may miss out on potentially exponential growth if they do not adopt digital assets now. They cited the long-term investment opportunities that exist in many forms of asset tokenization, ranging from virtual currencies to infrastructure such as platforms and applications — and growth – as among the reasons to consider the asset class.

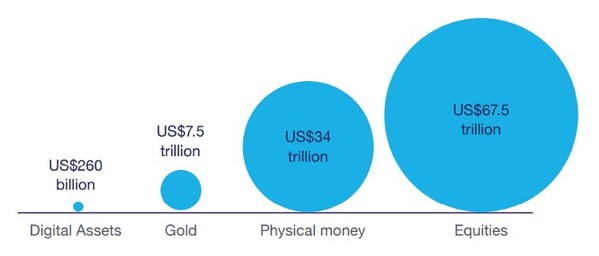

The total market capitalization of digital assets is just US$260 billion, relatively small compared to other traditional assets.

However, globally the digital asset market has tremendous growth potential, and is expected to grow from US$3.4 billion in 2020 to US$6.0 billion by 2025, at a CAGR of 12.0%.

In the HashKey Group report, some first mover investors highlighted the value of investing early to gain knowledge and experience to prepare for the wave.

Michel Lee, Executive President of HashKey Group said, “As an indication of the interest institutional investors have in this asset class, the inflow of institutional funds has contributed to the fluctuation of the prices of some virtual currencies in recent months.”

Lee said, “However, the digital asset class spans much more than just virtual currencies. There are tokenized equities and tokenized bonds and digital economy tokens. Institutional investors are also interested in these subcategories. Our report identifies corporate risk aversion, evolving regulatory frameworks, and perceived lack of supporting infrastructure as factors they consider carefully before adding exposure to digital assets to their portfolios.”

The Securities and Futures Commission (SFC) in Hong Kong announced in November 2020 that it will regulate all digital asset exchanges and trading to prevent market manipulation and money-laundering activities.

Angelina Kwan, Chief Operating Officer of HashKey Group said, “Many institutional investors are themselves regulated and have a fiduciary duty to fulfill. The new SFC regulations will enable more transparency, since only licensed operators can offer regulated virtual assets services and only professional investors can participate. As infrastructure is developed and regulation increases, institutional investors will become more confident about digital asset investment.”

Kwan adds, “In addition to digital currency, custody, trading platforms and security solutions are other digital asset investment opportunities that are more familiar to institutional investors. The development of the digital asset infrastructure in many ways mirrors the way traditional financial services infrastructure grew and matured. That trend makes institutional investors more comfortable as they consider digital asset investment opportunities.”

The Greater Bay Area (GBA) integration is another strategic initiative that could help to accelerate the adoption of digital assets by institutional investors. Hong Kong, as an international financial hub, plays a critical role in facilitating global trading, and is stimulated by innovative Chinese technology and payment solutions.

For example, China selected Hong Kong to launch the test for its digital yuan (digital version of China’s fiat currency), because it is the “most open and international city” in the GBA. An enhanced regulatory framework now being put in place here in Hong Kong will help nurture the digital assets ecosystem in the region.

Michel Lee said, “2021 is a strategic time for institutional investors to consider adding exposure to digital assets in their portfolios. Concern about the long-term future is redoubling investor interest in uncorrelated, more diversified asset classes. Once regulations are established and clarified, institutional investors can leverage Hong Kong as a strategic hub to capture the opportunities. To maximize their potential, they should work with professional partners with proven expertise and track records.”

About HashKey Group

HashKey Group is a leader in digital asset management and blockchain solutions. The Group provides a complete ecosystem across the entire digital asset landscape, ranging from capital, to custody, to technologies, trading, and exchange. HashKey’s senior team has deep investment, governance, and technology expertise gained at tier-one banks, regulators, and fintech ventures. HashKey identifies high potential opportunities and deliver end-to-end solutions that operate within regulatory frameworks with high compliance standards. The Group has operations in Hong Kong, Singapore and Japan, and extensive partnerships with fintech and blockchain solutions providers, academic institutions, and associations.

Official Website: https://www.hashkey.com/